|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Company to Refinance My Home: Exploring Top Options for HomeownersRefinancing your home can be a strategic move to reduce monthly payments or adjust the terms of your mortgage. Choosing the right company is crucial for a smooth refinancing process. This guide helps you explore the best companies for refinancing, tailored to your needs. Understanding Home RefinancingHome refinancing involves replacing your existing mortgage with a new one, often to secure a lower interest rate or change the loan term. It's important to understand the options available and how they might benefit your financial situation. Reasons to Refinance

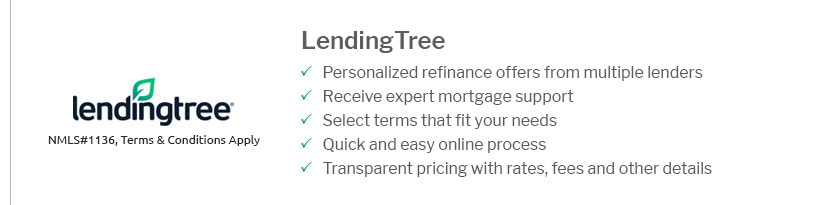

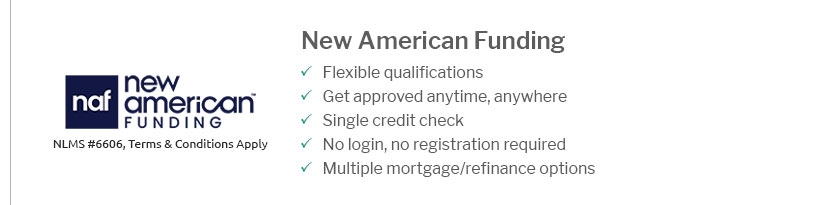

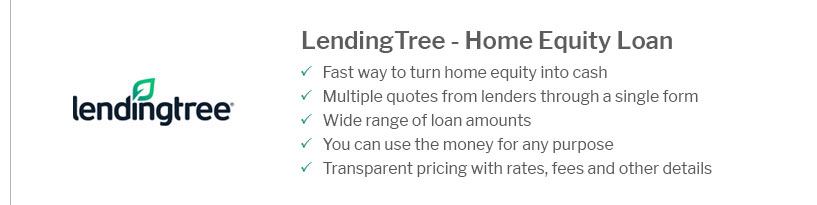

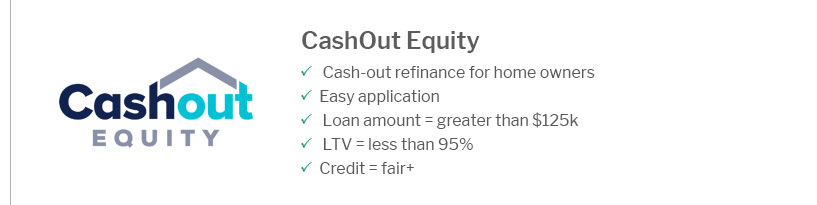

Top Companies for Home RefinancingThere are several reputable companies known for their refinancing services. Here are some of the most popular options: Quicken LoansKnown for its exceptional customer service and streamlined process, Quicken Loans offers a variety of refinancing options tailored to different homeowner needs. Better.comBetter.com is a tech-driven company that provides a completely online experience with no commission fees, ideal for tech-savvy homeowners. Bank of AmericaOffering a wide range of loan products, Bank of America provides personalized services and competitive rates. They are also among the banks that do FHA streamline refinance, a convenient option for existing FHA borrowers. Refinancing with Bad CreditRefinancing with bad credit can be challenging but not impossible. Some companies specialize in these situations, offering options for those with less-than-perfect credit scores. For instance, certain lenders focus on bad credit manufactured home refinance, providing tailored solutions to help improve financial stability. FAQs About Home RefinancingWhat are the costs associated with refinancing?Refinancing usually involves costs such as application fees, appraisal fees, and closing costs. It’s important to weigh these costs against the potential savings from a lower interest rate. How long does the refinancing process take?The refinancing process typically takes 30 to 45 days, depending on the lender and complexity of the transaction. Can I refinance with the same lender?Yes, many homeowners choose to refinance with their current lender, which can simplify the process due to an existing relationship. Choosing the best company to refinance your home depends on your unique financial situation and goals. It's advisable to compare offers from multiple lenders to ensure you're getting the best deal possible. https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

Best Mortgage Lenders for Refinancing - Lenders in More Detail - Rocket Mortgage - PenFed Credit Union - New American Funding - Farmers Bank of Kansas City - NBKC ... https://www.lendingtree.com/home/refinance/

Our picks for the best refinance lenders of 2025 - Best refinance lender overall: Rate - Best online mortgage refinance experience from a traditional bank: Chase. https://yourhome.fanniemae.com/own/refinance-options

Contact your mortgage lender for more information on the best refinance options for your specific needs.

|

|---|